Accounts Receivable Invoices

From the panel on the left side of the screen select Top customers All quotes detail or Outstanding quotes detail. Several important ratios rely on accounts.

Myob Sale Invoices Accounts Receivable Ezzybills

The internal control procedures for accounts receivable checklist below acts as a quick reference and sets out the most commonly encountered techniques available when dealing.

. You repay the advance in regular installments typically weekly or monthly. This is because the system can automatically generate invoices based on sales data meaning that there is no need for manual input. Optional Click a row on the report to see details of the underlying invoices and quotes.

The accounts receivable process is sometimes called bills receivable and some people simply call it invoicing. The units with accounts receivable responsibilities are Student Financials Housing and Residential Life Parking and Transportation and the Office of Research and Economic Development Red flags for this type of fraud are invoices to fake customers or invoices that do not match the type of business a customer might generate Accounts receivable risk refers to. Therefore every purchase made in credit creates both accounts payable and accounts receivable for the customer and the vendor respectively.

Automation can help to reduce errors and save time. An account receivable is documented through an invoice which the seller is responsible for issuing to the customer through a billing procedure. The invoice describes the goods or services that have been sold to the customer the amount it owes the seller including sales taxes and freight charges and when it is supposed to pay.

The accounts receivable financing business advances you a percentage of money against those invoices and charges you interest on this advance. An invoice email template for late overdue payments. The accounts receivable cycle starts when a serviceproduct has been delivered but not yet paid for and is completed when the invoice is settled and the amount paid in full.

Accounts receivable AR is money that your customers owe you for buying goods and services on credit. When invoices are paid finance credits the appropriate liabilities account and debits accounts receivable to account for the payment. You can calculate it by dividing net sales by average accounts receivable.

Entries in your AR are receivables and these represent outstanding invoices in your books. You retain control of collecting on the invoices and dealing with your customers. Accounts receivable AR is money customers owe your business typically from a sale on credit.

Find and open the Receivable Invoice Detail report. AR are recorded as an asset on your companys balance sheet. Accounts receivable is a necessary step in accounting because companies will often make arrangements to accommodate different payment scenarios and credit terms.

Therefore managing AR is such a critical business process and the quality of AR can determine whether or not a company thrives. What are accounts receivable. The formula for calculating accounts receivable turnover ratio is.

Your customers should pay this amount before the invoice due date. Your accounts receivable turnover ratio shows how quickly your AR department is collecting payments and turning that money into cash. The accounts receivable financing company will charge you.

If customer invoices are regularly becoming late and you have overdue as the norm it may be worthwhile distinguishing your business good and bad payers. It is also known as account receivables and is represented as current liabilities in balance sheet. Accounts Receivable Turnover in days 365Receivable Turnover Ratio.

Accounts receivable abbreviated as AR or AR are legally enforceable claims for payment held by a business for goods supplied or services rendered that customers have ordered but not paid for. Unpaid or outstanding invoices. Accounts receivable can include.

Read more under current. The purpose of accounts receivable internal controls is to ensure that sales invoices are properly recorded and that customers pay promptly in accordance with the agreed terms of business. A dashboard that presents receivables data.

These are generally in the form of invoices raised by a business and delivered to the customer for payment within an agreed time frame. Your accounts receivable consist of all the unpaid invoices or money owed by your customers. Accounts receivable invoice automation can help increase your invoicing processs efficiency and accuracy.

So the accounts receivable process includes things like sending invoices watching to see if theyve been paid taking steps to chase payment and matching payments to invoices also known as invoice reconciliation. An Accounts Receivable AR can mean the amount of money a customer owes a company for goods or services they received or the process of converting their debt into cash. If youve chased a customer repeatedly for an overdue unpaid invoice without any luck its time to change your accounts receivable tactics.

You can use the search field in the top right corner. In the Accounting menu select Reports. In accrual accounting your receivable balance is listed in the general ledger under current assets.

Accordingly Accounts Receivable Turnover in days is calculated using the following formula. Accounts receivable comes under the current assets of your company as it is the money you will receive in near future. This is the amount you send an invoice for.

ART net credit sales average accounts receivable. The above account receivables will be disclosed as If an invoice is raised the above account receivables will be disclosed as Trade receivables Trade Receivables Trade receivable is the amount owed to the business or company by its customers. Applicable late fees would also be accounted for as part of accounts receivable.

Accounts receivable is shown in a balance sheet as an. Accounts receivable overview. Accounts Receivable Turnover in days represents the average number of days your customer takes to make payment against goods sold on credit to him.

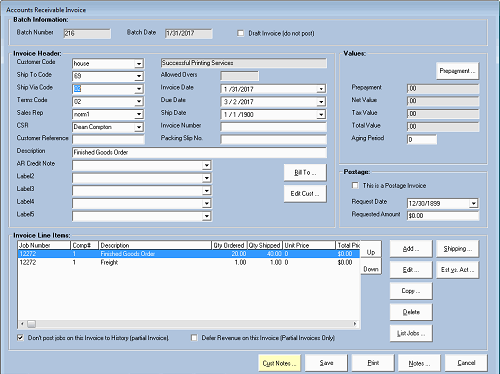

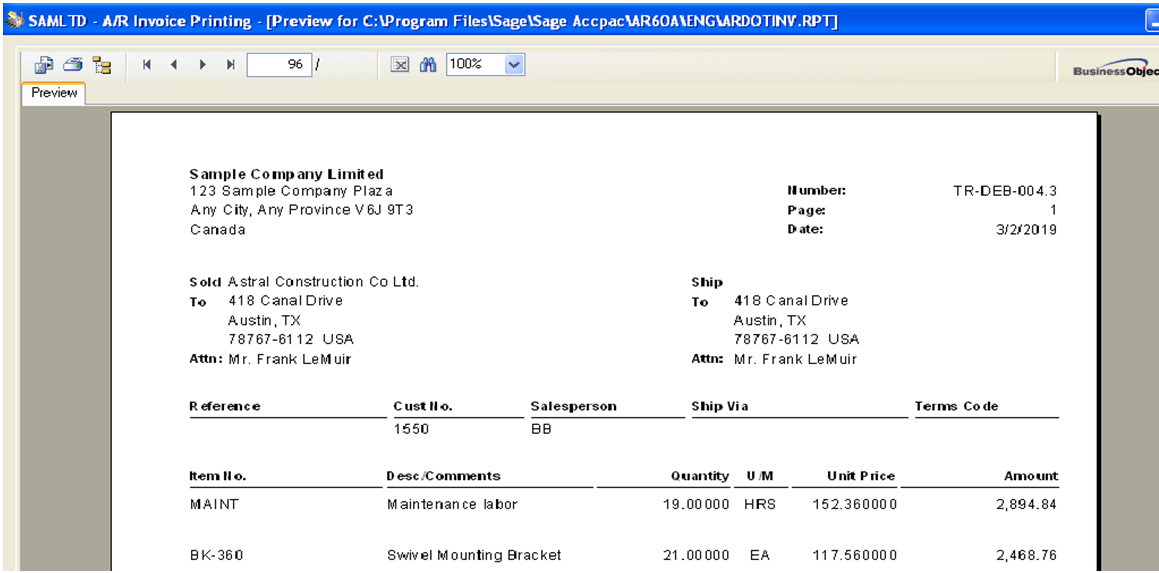

Account Receivable Transaction Reports In Sage 300 Erp Sage 300 Erp Tips Tricks And Components

Clients Profits X User Guide Billing Accounts Receivable

Accounts Receivable Invoicing Software Sage Canada

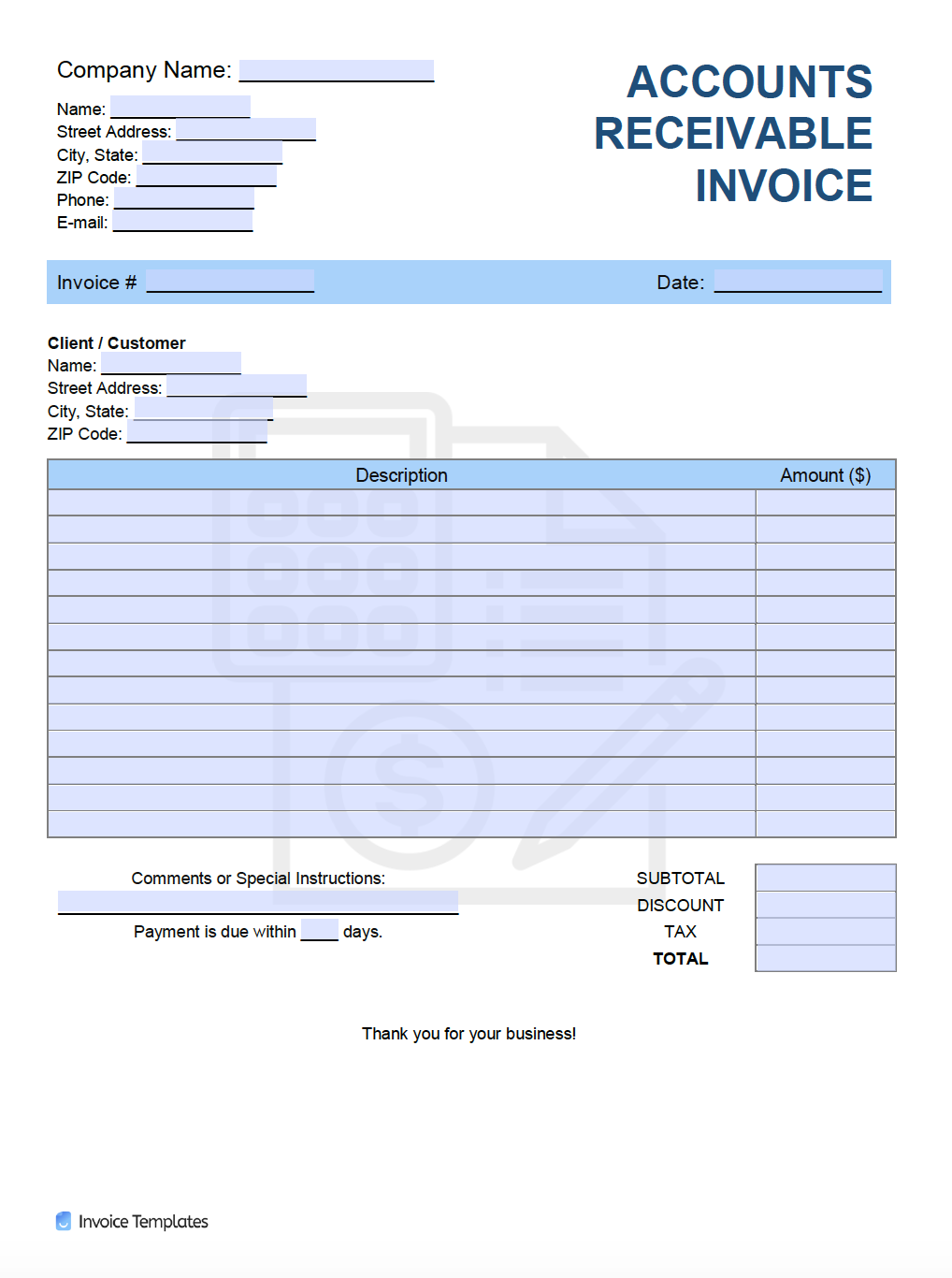

Free Accounts Receivable Invoice Template Pdf Word Excel

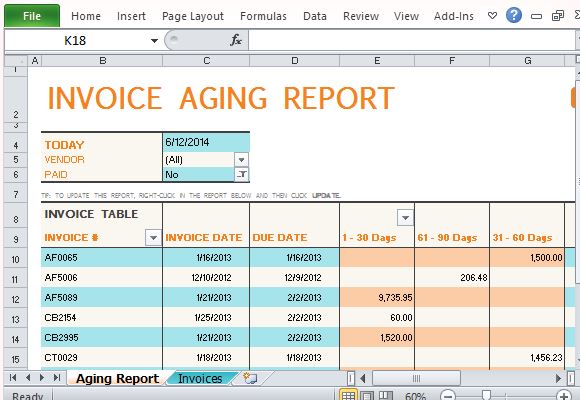

Track Accounts Receivable With Invoice Aging Report Template For Excel

Accounts Receivable Services Tfo Solutions Llc

Accounts Receivable Transactions

How To Clean Up Accounts Receivable In Quickbooks Osyb Number Crunch Bookkeeping Tips From Outsouce Your Books